Buying a house sounds like an intense and time-consuming process. After all, you need to think about things like a purchase agreement, getting a home inspection, and of course, getting and securing a mortgage. In this guide, we’ll walk you through every step of the process of buying a house. We’ll include resources you can use to streamline the process, and even avoid the extra cost of a real estate agent if you prefer!

Use Mortgage Calculators

You may wonder how on Earth you’re ever going to the 20% down payment most people still think you have to make in order to qualify for a home mortgage. The reality is that over half of homebuyers buy a home with a down payment of 6% or less of the home’s value. The catch is that when you pay less than 20%, you end up paying private mortgage insurance (PMI), until you’ve paid at least 20% of the home’s value. Or if you qualify for a government FHA loan (income-based), you won’t even have to pay PMI. Another option is paying “single premium PMI”, which is paying PMI at closing rather than during the loan. Some of the best mortgage calculators to help you figure out what solution is right for you includes:

BankrateNerdwalletZillowTrulia

Coming Up With a Down Payment

Of course, the next question you may have is how you come up with the down payment in the first place. People use some creative ideas to pull together what they’ll need at closing. To figure out how much you have, consider all of the following sources for a home down payment.

Family: Will your parents potentially give you some of the down payment to help you buy your first home?Savings: How much have you saved for things like a vacation or your next car? Can those funds be diverted toward the down payment?Assets: Do you have a boat, snowmobile, power tools, or other things you don’t want as much as your first house? Consider selling them.Bonuses: Do you get an annual bonus at work that you could apply to the house purchase?401k or retirement plan: How much have you saved in your employer retirement plan? You can withdraw funds without penalty for your first home purchase.

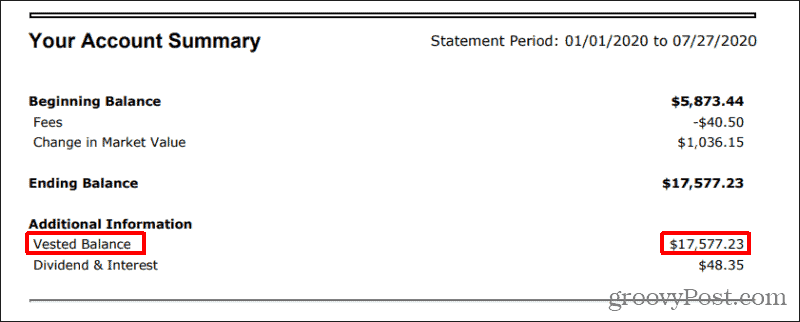

The retirement plan is a popular vehicle people use to get money for a down payment. To figure out how much you can borrow, first log into your employee retirement account and check for the “vested balance”.

You can typically take a loan out up to that balance. You’ll have to pay back the loan in installments out of each paycheck. Check the “loan options” area of your retirement account to research those details. Initiating a loan is usually very fast, and the check will arrive in only 1 to 2 weeks.

Finding a House

Before you buy a house, you have to find one. That goes without saying. If you’re lucky, you already know a seller who’s interested in entertaining offers. If you don’t, you’ll need to hunt for your dream home and make an offer. Now that you know how much of a home you can afford, it’s time to start shopping. Some of the best real estate sites for finding a home include the following.

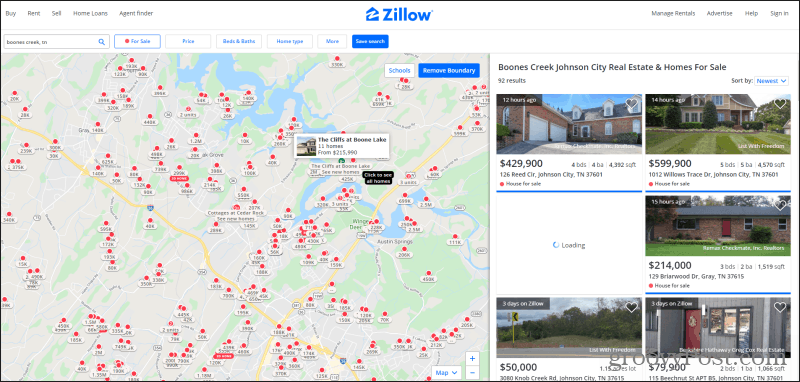

Zillow

You can use Zillow to shop for apartments or houses. The approach and interface work the same. Search an address, and on the left, you’ll see a map of all available homes with a red dot, along with their asking price. On the right, you’ll see all listings.

What’s great about Zillow is it helps you find home prices in the neighborhoods where you’d like to live, with very little effort. There are filters for price, number of bedrooms and bathrooms, square footage, year built, and much more.

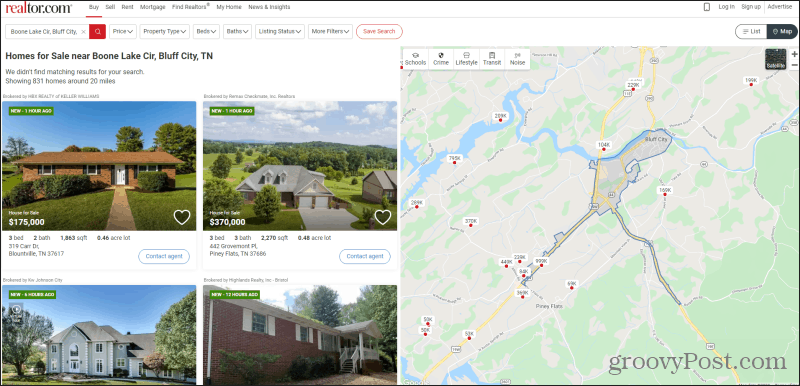

Realtor

The real estate search site Realtor.com has been the top dog in the home search website arena long before all the newer sites came along. When you first search for an address you’ll see the traditional listing style the site has always used. But you can select Map on the upper right to see a view similar to Zillow’s.

It also features most of the same filters, and for the most part, is almost exactly the same as Zillow. It’s possible you may find a few different properties on the two sites, but mostly the listings come out of the same MLS database. So you can’t go wrong whichever site you use.

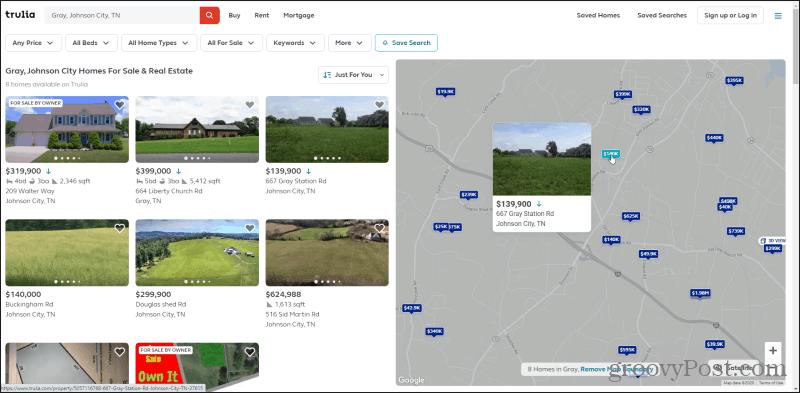

Trulia

The site Trulia works much the same way as the other two above, but the interface is slightly different. You’ll see a grayed-out map with blue prices on the right. Just hover over each price to see an image of the home. And click to see more details.

Use the filters in the top menu to cull down the listings to only those properties that match what you’re looking for. Zoom in or out on the map to expand or focus your search for listings in any area or neighborhood.

HomeFinder

The real estate search site HomeFinder is somewhat unique because it breaks down listings into For Sale, Foreclosures, Rentals, and Rent To Own.

Foreclosures could offer a creative way to reduce the amount you need to pay for your first home, but you’ll need to accept the risks that come along with purchasing them. Rent to Own is also a good option if you can’t seem to pull together a down payment immediately. It can give you time to save up while you’re also paying toward the ultimate offer on the house. Once you find a house, you may want to research its history before buying it!

Making an Offer

You’ve found a house in your price range. You know how much you can bring to closing. Now it’s time to make an offer. To do this, there are two approaches. There’s the easy way, which is calling the number on the listing and talking to the real estate agent who’s selling the house for the homeowner. Or, if you find a house for sale on Craigslist or through local word-of-mouth, you could make an offer directly. A home sale without a realtor can save the homeowner up to 10% of the purchase price in realtor fees, so often they’ll be more willing to negotiate on price. But to do this, you’ll need a good purchase agreement both you and the homeowner can sign that you can give to your mortgage agent. The purchase agreement doesn’t have to be perfect, it just has to include the basic elements of the agreement. You can find some great templates here:

eForms: Search for a real estate agreement tailored by state requirements.LegalTemplates: Just select a state and select Create Document. Answer basic questions, and download the template.TemplateLab: Select Residential Purchase and Sale Agreement from the dropdown, select the state, then click on Create Document.LawDepot: Just select the state where you’re buying and select Create My Document to download the template.RocketLawyer: Lets you build the template with basic information and then print or share it as a PDF.

It may feel scary to go through a home purchase without a realtor, but in reality, the mortgage lender does all the hard work. If you make sure you have a good mortgage agent helping you along, they’ll make sure all of the I’s are dotted and the T’s are crossed. And you’ll save a fortune in realtor fees.

Preparing Your Information

Here’s the hard part. Pulling together all of your information that the mortgage is going to ask for. And there’s going to be a lot. This checklist will help you gather that information so you can shorten the time between application and closing.

1. Bank Statements

You’re going to need to download 30-day bank statements of your checking and savings accounts, especially if you’re transferring retirement funds for your down payment. Just go to your bank and look for “eStatements” or “Electronic Statements” on the menu.

You can usually find your most recent bank statement which will contain 30 days of transactions. Just download the PDF and store it on your computer. Repeat for all of your bank accounts.

2. Tax Forms

You’re going to need your last 2 years of tax returns. Have no fear, the IRS has finally caught up with modern technology. Just go to the View Your Account page on IRS.gov and select Create or view your account. If you have an account, the IRS will SMS you a 6 digit code you’ll need to enter. If you haven’t created one, then do so. Once you’re in, just select View Tax Records in the box on the right, then Get Transcript on the next page. Select a reason for getting the transcript (you can leave the Customer File Number blank), and select Go.

Select the year you want and you’ll have the option to download all details from those transcripts. If the mortgage lender requires a copy of the actual transcripts you filed, you’ll need to dig those out of the box in the closet or order a new copy from the IRS by downloading, filling out, and mailing Form 4506.

3. Get a Free Credit Report

Every year, you’re entitled to a free credit report from the three reporting agencies. It’s a good idea to get a copy before the mortgage company runs your credit so you don’t run into any surprises. Get them here:

TransUnionEquifaxExperian

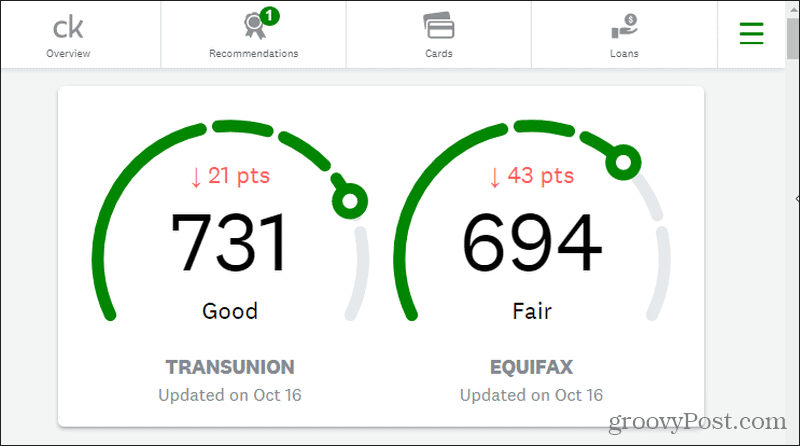

You can also get a credit rating estimate from Credit Karma if you don’t want to take the time to order your credit reports.

Just keep in mind this is an estimate and is often 40 to 60 points above or below the actual value. If you’re very concerned about your credit, ordering actual credit reports is the best option.

Closing the Deal

You’re almost at the closing table! All that’s left is getting that huge chunk of down payment cash sitting in your savings account over to the title company before the day of closing. This requires a wire transfer. Don’t worry, it isn’t as difficult as it seems in the movies. Banks do it all the time. Before you visit your bank to perform the transfer, make sure you have all of the following information from the title company:

The Recipient’s full name, address, and phone numberBank name, address, and phone number of the recipientRecipient’s bank routing number and the bank account numberYour bank account number where the down payment is stored

Go into the bank to do the transfer so they can verify your identity with a photo ID. Once you’re done, the down payment will be sitting in the title company’s bank account and ready for you and the seller to sign all the closing papers!

![]()